- 2,234

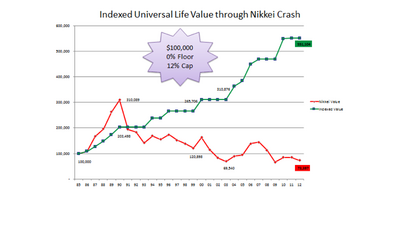

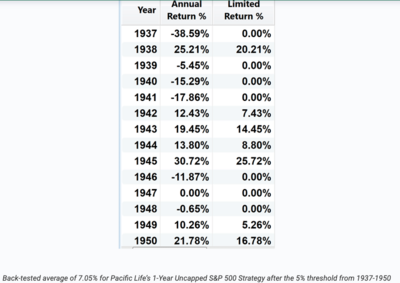

I went through the trouble of getting licensed and originating these contracts because I think they are better than any alternative investment vehicle. I can't directly invest in an index nor do I have the accredited investor status to buy the institutional index options they are buying and dynamically hedging.

You got licensed in insurance, in California - just to sell yourself this policy?

-talk about adding fees to your investment.

License Costs + Cont Ed + E&O + who knows what else...